사용자:Jjw/작업장2

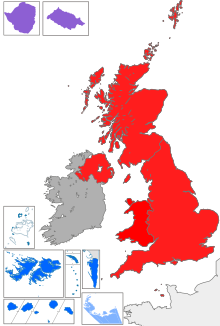

파운드 스털링(Pound sterling, 기호:£, ISO 코드: GBP)은 영국과 영국 왕실령의 공식 통화이다. 간단히 줄여 파운드 또는 스털링이라고 부른다.[1][2][3][4] 하위 단위로 페니, 실링 등이 있다. 1 파운드 스털링은 100 페니 또는 20 실링이다.

파운드 스털링은 미국 달러, 유로, 일본 엔에 이어 외환 시장에서 네번째로 많이 거래되는 통화이다.[5] 이 네 통화와 중국 위안을 합하여 IMF의 기축 통화를 이룬다. 또한 파운드 스털링은 외환보유고의 확보를 위한 준비 통화로도 사용되며 2021년 중반 기준 준비 통화량 5위를 기록하고 있다.[6]

영국 왕실령인 저지섬, 건지섬, 맨섬은 자체 지역 통화를 발행하고 있지만, 환율은 파운드 스털링과 대등하도록 법률에 따라 고정되어 있다.[7] 영국의 해외 영토인 지브롤터, 포클랜드 제도, 세인트헬레나 등의 지역 화폐도 파운드 스털링과 대등하다. 잉글랜드 은행이 중앙 은행으로서 발권 은행의 역할을 한다.

이름[편집]

파운드라는 이름을 가진 통화가 여럿 있고 질량의 단위로도 파운드가 쓰이기 때문에 공식적으로 언급할 때에는 파운드 스털링이라고 명기한다. 그러나 일상 생활의 거래에서는 그저 파운드 또는 쓰털링이라고 표현하기도 한다. 다른 나라의 파운드 통화와 구별할 때에는 영국 파운드라고 부르기도 한다.

어원[편집]

스털링이란 말은 노르드어에서 "작은 별"이란 뜻이다. 노르만 왕조 시기부터 은화 동전, 특히 페니 은화를 가리키는 말로 쓰였다.[8][9]

한편 스털링의 어원이 한자 동맹에서 기원했다는 주장도 있다. 독일어에서 발트해는 "동해"를 뜻하는 오스트시(Ostsee)인데, 이 때문에 발트해 상인들은 "오스털링즈"(Osterlings) 또는 "이스털링즈"(Easterlings)로 불렸다.[10][11] 1260년 헨리 3세는 런던에서 이들의 상업을 보호하고 사무실을 내기 위한 땅을 임대하여 주었다. 1340년대 무렵 한자 동맹의 런던 사무실은 "이스털링즈 홀"로 불렸다.[12] 잉글랜드에서 한자 동맹이 발행한 주화가 자주 사용되었는데, 잉글랜드의 상인들은 이 것을 "이스털링" 파운드 또는 그냥 줄여서 "스털링" 파운드라고 했다고 한다.[13]

브리태니커에는 스털링이 노르만의 잉글랜드 정복 이전인 8세기 무렵 앵글로색슨 왕국들에서 이미 주화의 의미로 쓰였다고 밝히면서 당시 파운드 스털링이란 트로이 파운드와 같은 무게의 은을 뜻했다고 밝히고 있다.[14] 1 트로이 파운드는 12 트로이 온스로 은을 비롯한 귀금속 거래에서 오늘날에도 여전히 사용되는 단위이다. 트로이라는 명칭은 중세시기 귀금속 거래 중심지였던 프랑스의 트루아에서 유래하였다.[15][16] 훗날 런던탑의 왕실 조폐국은 트로이 파운드보다 조금 더 적은 양인 약 350 그램을 1 파운드로 정의하여 사용하였다. 이를 타워 파운드라고 한다.

기호[편집]

파운드 스털링의 통화 기호는 £ 이다. 1975년 이후 발행된 지폐부터 L 자에 가로줄 하나를 쓰고 있다.[17][18] 가로줄이 둘인 ₤)은 1725년 이후 £과 함께 간간히 쓰였다.[17] 책, 신문, 편지 등에선 그냥 L 로 표기하기도 하였다.[19] 파운드 스털링의 기호는 대문자 L의 중세풍 흑자체 에서 기원한 것으로 야드파운드법에서 무게를 재는 단위 파운드와 같이 고대 로마의 무게 단위 리브라(libra)에서 온 것이다. 런던탑에 있었던 옛 왕실 조폐국이 1 파운드 무게의 스털링 실버의 가치를 기준으로 화폐를 만들었기 때문이다.[20][21]

통화 코드[편집]

ISO 4217는 파운드 스털링의 통화 코드로 GBP를 부여하고 있다. GB는 그레이트 브리튼(Great Britain)의 약자로 ISO 3166-1 alpha-2에 따른 영국의 국가 코드이고 P는 파운드의 약자이다. 간혹 유나이티드 킹덤 파운드의 약자인 UKP로 표기하는 경우도 있으나 이는 정식 표기가 아니다.

하위 단위[편집]

파운드 스털링 주화는 실링 또는 펜스로 세분되었다. 실링은 로마의 주화 단위였던 솔리두스에서 유래하였고, 펜스 역시 로마의 주화였던 데나리우스에서 유래하였다.[22] 런던탑의 왕실 조폐국이 기준으로 삼은 1 파운드는 미터법으로 환산하면 약 350 그램으로 상당히 묵직한 양이었고[23] 실제 생활에선 주로 실링이나 페니가 사용되었다. 파운드 스털링이 만들어지기 시작할 때의 영국은 10진법이 확립되어 있지 않았기 때문에 1파운드는 20 실링 또는 240 펜스로 나뉘었다. 1971년이 되어서야 1 파운드를 100 펜스로 다시 정립하여 십진법화 하였다.

옛 하위 단위[편집]

1971년 십진법화 되기 이전까지 1 파운드는 20 실링이었고, 1 실링은 12 펜스이었다. 따라서 1 파운드를 펜스 단위로 나타내면 240 펜스가 되었다. 실링은 s, 페니는 d로 표기하였는데 둘 모두 영어가 아닌 라틴어의 약자이다. s는 옛 로마 화폐 단위인 솔리두스를 d는 데나리우스를 뜻한다. 물건의 가격은 실링과 펜스를 섞어 표기하였다. 예를 들어 《이상한 나라의 앨리스》에 등장하는 모자 장수는 자신이 쓰고 다니는 모자에도 10실링 6펜스라는 가격표를 붙이고 있다. 10 실링 6 펜스는 10/6 또는 10s 6p 로 표기하였다. 읽을 때는 "텐 앤드 식스" 또는 "텐 앤드 식스 펜스" 식으로 읽었다.

실링과 펜스 모두 다양한 동전이 주조되었고 그 가운데 몇은 오늘날에도 쓰인다. 플로린은 2 실링짜리 주화이고, 크라운은 5 실링짜리 주화이다. 크라운의 절반 값인 하프 크라운, 4분의 1 페니인 파딩 등이 있었다.

전통적으로 영국 주화는 은화였으나 1947년 구리-니켈 합금 주화가 나오면서 1950년대가 되면 은화는 매우 드물어졌다.[24][25]

십진법화[편집]

1971년 2월 5일 파운드의 세부 단위는 펜스를 기준으로 십진법 체계에 따라 재정립되었다. 이날 이후 1 파운드는 100 펜스로 세분되었고, "새 페니"는 이전의 페니와 구분하기 위해 p를 기호로 삼았다. 읽을 때에도 이전 "옛 페니"와 구분하기 위해 "50 피"로 읽는 경우가 많았다. 펜스의 값이 240분의 1 파운드에서 100분의 1파운로 상승하였기 때문에 실제 거래에선 혼란이 있기도 하였다. 십진법화 이후 1984년 까지 2분의 1 페니의 가치를 지닌 하프페니가 주조되기도 하였다.[26]

역사[편집]

파운드 스털링은 8세기 무렵 프랑크 왕국 카롤루스 왕조의 리브르가 잉글랜드에서 사용되면서 도입되었다. 도입 초기엔 은의 무게 그 자체를 가치로 삼았지만, 이후 은과 구리를 섞은 스털링 실버가 기준이 되었고 시간이 지남에 따라 1 파운드와 맞먹는 은의 무게는 점점 줄어들었다. 8세기 이후 1914년까지 1 파운드 스털링의 시대별 가치는 다음의 표와 같다.[27][28]

| 연도 | 은 (그램, 온스) |

금 (그램, 온스) |

|---|---|---|

| 800 | 349.9 g (11.25 ozt) | - |

| 1158 | 323.7 g (10.41 ozt) | - |

| 1351 | 258.9 g (8.32 ozt) | 23.21 g (0.746 ozt) |

| 1412 | 215.8 g (6.94 ozt) | 20.89 g (0.672 ozt) |

| 1464 | 172.6 g (5.55 ozt) | 15.47 g (0.497 ozt) |

| 1551 | 115.1 g (3.70 ozt) | 10.31 g (0.331 ozt) |

| 1601 | 111.4 g (3.58 ozt) | 유동적 |

| 1717 | 111.4 g (3.58 ozt) | 7.32238 g (0.235420 ozt) |

| 1816 | - | 7.32238 g (0.235420 ozt) |

파운드 스털링은 도입 이후 화폐 단위가 바뀌지 않은 세계에서 가장 오래된 화폐 가운데 하나이다. 20세기 초까지도 표기된 액면 가치대로 은 또는 금을 교환할 수 있는 태환지폐로 유지되었으나 1931년 대공황의 여파로 금본위제가 붕괴되면서 더 이상 금은으로 교환되지 않는 불환지폐가 되었다.[29]

800년 무렵 앵글로 색슨[편집]

파운드는 앵글로색슨 시기 화폐 단위로 쓰이기 시작했다. 당시 통용된 주화는 240분의 1 파운드의 가치를 지닌 페니 은화였다. 이는 훗날 런던탑의 왕실 조폐국으로 이어저 1 타워 파운드의 스털링 실버를 뜻하게 되었고 오늘날 영국 화폐 제도의 기원이 되었다. "스털링"을 처음 도입한 것은 머시아의 오파로 그는 240분의 1 파운드 스털링의 가치를 지니는 페니 은화를 주조하였다.[31] 오파의 페니 은화는 사실 제 무게를 지닌 것이 거의 없었고 그저 그렇게 정의된 것에 불과하였다. 당시 실제 페니 은화의 무게는 들쭉날쭉하였으며 240 개의 무게는 1 파운드 스털링에 못 미쳤다.[32]

1 파운드 스털링은 상당히 큰 단위였고 그것을 나눈 실링이나 페니도 실거래에선 매우 큰 단위였기 때문에, 1 페니의 절반인 하프페니나 4분의 1인 파딩이 실제 거래에서 주로 쓰였다.[33]

13 세기 무렵 중세[편집]

초기에 주조된 페니는 가능한 순도를 높인 순은으로 제작되었다. 그러나 헨리 2세 시기에 이르러 은의 함량은 92.5%로 낮춰졌다.[27] 이렇게 제작된 주화용 은합금을 스털링 실버라 부르게 되었는데, 스털링 실버는 20세기까지 계속하여 사용되었다. 훗날 그레샴의 법칙으로 불리게 된 "악화가 양화를 구축한다"는 현상은 스털링 실버와 순은 사이에서도 발생하여 시간이 지남에 따라 순은 주화는 자취를 감췄다.

1266년부터 몇 차례에 걸쳐 프랑스의 그로 트루누아(프랑스어: Gros tournois, 투르 주화)가 잉글랜드에 유입되었다. 잉글랜드에서도 이후 4 펜스 주화인 그로트(Groat)가 주조되기 시작하였다. 2 펜스 주화는 하프 그로츠(half groats)로 불렸다.[34] 1257년 은화 20 페니의 가치를 지닌 2 페니 금화가 주조되었으나 유통은 실패하였다.[35]

잉글랜드의 주화는 12 온스의 타워 파운드를 기준으로 제작되어 240 개의 페니 주화로 나뉘었는데, 1279년 제작된 주화는 실제 제작 과정의 손실을 감안하면 243 페니가 들었다.[36] 중세 시대에는 유럽의 여러 지역에서 갖가지 주화가 제조되었는데, 그 가치 역시 일률적이지 않았다. 잉글랜드 그로트의 가치는 4 펜스였지만, 프랑스의 그로 트루누아는 12 데니에르(펜스)였고, 베네치아의 그로소(grosso)는 26 데나리였다.

에드워드 3세[편집]

에드워드 3세시기 플랑드르 지역은 직물 산업의 중심지였고 잉글랜드로부터 원료인 양모를 수입하면서 대금을 금화로 지급하였다. 이 때문에 잉글랜드에서도 금화가 유통되었고 그 후 2 세기 동안 파운드 스털링보다는 금화가 대규모 무역에 사용되었다.[27]:41 1344년 잉글랜드 최초의 통화 개혁에서 다음과 같은 변화가 있었다.

이 조치에 적용된 금-은 교환 비율 1:12.5는 당시 유럽 대륙에서 통용되던 1:11 비율보다 높은 것이었는데 이를 보정하기 위해 잉글랜드는 주화의 주조 기준을 변경하였다.

- 잉글렌드 페니의 무게를 18 그레인 더 줄였다.

- 새롭게 제조된 노블 금화의 무게를 120 그레인 늘리고 순도를 191/192 즉 99.48%로 올리면서[37] 값어치를 6실링 8 펜스 즉 80 펜스로 정하였다.

이렇게 보정한 금-은 교환 비율은 대략 1:11.2로 유럽 대륙의 것에 근접하게 되었다.

노블 주화는 40 펜스 값어치의 하프 노블, 20 펜스 값어치의 파딩 노블(또는 쿼터 노블)도 주조되었다.[37] 이는 잉글랜드 최초의 대중적인 금화 유통이었다.[38]

헨리 4세[편집]

헨리 4세 시기 백년전쟁의 여파로 잉글랜드 페니의 무게는 다시 15 그레인이 줄었고 하프 노블 금화 역시 54 그레인이 줄었다.[27] The gold-silver ratio went down to 40*0.899/3.481 = 10.3.

백년전쟁의 제3기인 랭커스터 전쟁 이후 40 펜스 짜리 하프 노블은 프랑스의 리브르와 거의 같은 가치를 지니게 되었고, 하프 그로트 은화 역시 파리의 1 솔과 거의 같아지게 되었다.[39] 또한 1434년 플랑드르의 화폐 개혁으로 새롭게 주조된 네덜란드 휠던 역시 40 펜스의 값어치에 근접하였다.[40] 이렇게 각 지역의 주화들 가격이 엇비슷하게 맞추어지자, 잉글랜드에서는 1560년대 까지 자체적으로 주조한 하프 노블과 하프 그로트가 유럽 대륙의 리브르, 솔 등과 섞여서 쓰였다.

대부진[편집]

15세기 잉글랜드는 대부진으로 불리는 장기 경기 침체를 겼었다. 게다가 주화를 만들 금속마저 크게 부족하게 되자 잉글랜드 페니 은화의 무게는 다시 12 그레인 더 줄어들었고, 이전의 노블을 대신한 엔젤 금화가 무게가 줄어든 40 펜스에 맞추어 새로 만들어졌다.[27]

대부진 시기에 새롭게 주조된 40 펜스의 무게는 대략 1 트로이 온스와 같아지게 되었다. 프랑스의 주화 주조 기준이 트로이 온스였고 잉글랜드 뿐만 아니라 독일 지역의 굴덴그로센(Guldengroschen)의 무게 역시 1524년 대략 1 트로이 온스가 되면서, 프랑스 리브르 주화는 유럽 국제 무역의 표준으로 자리잡게 된다.[27]:361

튜더 시기[편집]

16세기 스페인의 아메리카 대륙 식민화이후 유럽으로 대규모 은이 유입되었다. 이 은의 일부가 합스부르크 네덜란드를 거쳐 잉글랜드로 유입되자 은본위제를 쓰고 있던 파운드 스털링의 가치 역시 절하되었다.[41][28]

은화 주조에 사용되는 스털링 실버는 1 온스에 40 페니였다가 60 페니로 세분되었다. 은화 절하에 따라 금화가 상대적으로 절상 되었기 때문이다. 1551년 에드워드 6세는 5 실링 가치의 주화 크라운을 발행하였다.

금본위제의 도입[편집]

은본위제의 파운드 스털링 발행은 17세기 이후 1816년 금본위제로 변환 될 때까지 큰 변화 없이 유지 되었다. 1717년 이미 금본위제의 도입을 위해 1 기니를 21 실링으로 확정하는 법안이 시행되었지만, 당시까지도 금본위제는 안정적이지 않았다.

1663년 도입된 기니 주화는 22 캐럿(순도 약 91.67%)의 금 12 트로이 온스로 441⁄2 기니를 주조하였다. 애초의 주조 의도는 1 기니를 1 파운드 스털링 또는 20 실링과 교환되도록 하는 것이었지만, 실제로는 21 실링 또는 1 파운드 5 펜스로 거래되었다.[42] 중세 시기 금은 교환 비가 1:11 이었던 것에 비해 은의 가치가 많이 떨어졌음을 알 수 있다.

아이작 뉴턴이 왕실 조폐국의 수장으로 재직하고 있던 1717년 1 기니 금화의 가치를 21 실링으로 확정하였다. 그러나 유통되는 은화의 무게가 표기된 가치보다 가벼운 것이 많아 실제 거래에서는 1 : 15.1까지 교환율이 올랐다. 다시 한 번 악화가 양화를 구축하는 현상이 일어나 시중에서 기니 금화를 보기는 어려워졌는데 이로 인해 애초 의도하였던 금본위제의 도입이 지연되었다. 더욱이 당시 은화와 동전을 주조하는 화폐 발행처도 여러 곳이어서 1816년 법률의 정비 이전까지 소액 거래에 혼란을 주었다.[43]

1816년 화폐 개혁법은 나폴레옹 전쟁의 여파로 타격을 입은 파운드 스털링을 안정시킬 목적으로 제정되었다. 동시에 당시까지 근 1천년 이상을 이어오던 은본위제를 대신하여 금본위제를 도입하였다. 한편 스코틀랜드는 독자적인 파운드 스코트 화폐를 발행하고 있었는데 18세기 무렵 이미 금본위제를 실시하고 있었지만 잉글랜드의 스털링 파운드와 고정 환율로 묶여 있었기 때문에 역외 거래에 문제가 있었다. 은본위 스털링 파운드가 실제로는 무게가 덜 나가는 악화들이 많았기 때문이다. 1816년 화폐 개혁은 잉글랜드 역시 금본위제를 채택하여 스코틀랜드와의 환율 문제도 해결하였다. 그러나 금본위제 도입 이후 여전히 은만 거래 수단으로 인정하던 청나라와 무역 갈등이 발생하게 되었다. 이는 아편의 거래와 더불어 영국과 중국 사이 갈등의 원인이 되었고, 결국 아편 전쟁이 일어나게 되는 원인으로 작용하였다.[44] 금본위제가 도입되자 상업 거래에서 은화의 지위는 내려갔다. 더 이상 잘 쓰이지 않게 된 은화는 장신구로 개조 되거나 녹여져 은제품으로 팔렸다.

미국 독립 전쟁과 나폴레옹 전쟁이 진행되는 동안 잉글랜드 은행이 발행하는 지폐는 금본위제 법정 통화가 되었다. 잉글랜드 은행은 금화 뿐만 아니라 은화의 전황을 염려한 토큰도 제작하였다. 1817년 소브린 금화가 20 실링으로 책정되어 발행되었다.

19세기 후반 쯤 영국의 파운드 스털링은 세계적인 기축 통화가 되었다. 1889년에서 1890년 사이 넬리 블라이은 《72일 간의 세계 일주》를 하면서 여행 경비 대부분을 환전 없이 잉글랜드 은행의 지폐로 지불하였다.[45] 이것이 가능한 이유는 영국 자체가 거대한 식민지를 거느린 제국인 이유도 있었지만, 그 사이 많은 나라들이 금본위제를 도입하였기 때문이다. 금 교환이 보장되어 있는 지폐들 끼리는 거의 고정 환율로 교환되었다. 20세기 초 1 파운드 스털링은 4.87 미국 달러, 4.87 캐나다 달러, 12.11 네덜란드 휠던, 25.22 프랑스 프랑, 20.43 독일 금 마르크, 9.46 러시아 루블, 24.02 오스트리아-헝가리 크로네로 교환되었다.[46]

중앙은행의 발권[편집]

1694년 중앙은행인 잉글랜드 은행이 설립되었다. 1694년 설립 당시에는 주식회사 형태의 특허 기업이었다.[47][48] 잉글랜드 은행은 지폐를 발행하는 발권은행 이기도 하다. 중앙은행 한 곳에서만 단독으로 지폐를 발행하는 여러 나라와 달리 영국의 경우엔 발권 은행이 여러 곳 있다.

잉글랜드 은행의 설립 목적은 정부의 기금 마련에 있었다. 당시 잉글랜드는 해군 육성과 철강업 지원을 위해 많은 기금이 필요하였고, 잉글랜드 은행의 대출 업무로 기금을 조성하였다.[49] 20세기 초까지 잉글랜드 은행이 발행한 지폐는 금으로 교환이 가능한 태환지폐였고, 그 외에도 각종 국채도 발행하였다.

현대[편집]

The gold standard was suspended at the outbreak of First World War in 1914, with Bank of England and Treasury notes becoming legal tender. Before that war, the United Kingdom had one of the world's strongest economies, holding 40% of the world's overseas investments. But after the end of the war, the country was highly indebted: Britain owed £850 million (about £423억 today)[50] with interest costing the country some 40% of all government spending.[51]

By 1917, production of gold sovereigns had almost halted (the remaining production was for collector's sets and other very specific occasions), and by 1920, the silver coinage was debased from its original .925 fine to just .500 fine.[출처 필요] That was due to a drastic increase in silver prices from an average 27s 6d [£1.375] per pound (mass) in the period between 1894 and 1913, to 89s 6d [£4.475] in August 1920.[52]

To try to resume stability, a version of the gold standard was reintroduced in 1925, under which the currency was fixed to gold at its pre-war peg, but one could only exchange currency for gold bullion, not for coins. On 21 September 1931, this was abandoned during the Great Depression, and sterling suffered an initial devaluation of some 25%.[53]

Operation Bernhard was the codename of a secret Nazi plan devised during the Second World War by the RSHA and the SS to destabilise the British economy via economic warfare by flooding the global economy and the British Empire with forged Bank of England £5, £10, £20, and £50 notes.

Bretton Woods[편집]

In 1940, an agreement with the US pegged the pound to the U.S. dollar at a rate of £1 = $4.03. (Only the year before, it had been $4.86.)[54] This rate was maintained through the Second World War and became part of the Bretton Woods system which governed post-war exchange rates. Under continuing economic pressure, and despite months of denials that it would do so, on 19 September 1949 the government devalued the pound by 30.5% to $2.80.[55] The move prompted several other currencies to be devalued against the dollar.

In 1961, 1964, and 1966, the pound came under renewed pressure, as speculators were selling pounds for dollars. In summer 1966, with the value of the pound falling in the currency markets, exchange controls were tightened by the Wilson government. Among the measures, tourists were banned from taking more than £50 out of the country in travellers' cheques and remittances, plus £15 in cash;[a] this restriction was not lifted until 1979. The pound was devalued by 14.3% to $2.40 on 18 November 1967.[55][56]

Decimalisation[편집]

Until decimalisation, amounts were stated in pounds, shillings, and pence, with various widely understood notations. The same amount could be stated as 32s 6d, 32/6, £1 12s 6d, or £1/12/6. It was customary to specify some prices (for example professional fees and auction prices for works of art) in guineas (one guinea was 21 shillings) although guinea coins were no longer in use.

Formal parliamentary proposals to decimalise sterling were first made in 1824 when Sir John Wrottesley, MP for Staffordshire, asked in the House of Commons whether consideration had been given to decimalising the currency.[57] Wrottesley raised the issue in the House of Commons again in 1833,[58] and it was again raised by John Bowring, MP for Kilmarnock Burghs, in 1847[59] whose efforts led to the introduction in 1848 of what was in effect the first decimal coin in the United Kingdom, the florin, valued at one-tenth of a pound sterling. However, full decimalisation was resisted, although the florin coin, re-designated as ten new pence, survived the transfer to a full decimal system in 1971, with examples surviving in British coinage until 1993.

John Benjamin Smith, MP for Stirling Burghs, raised the issue of full decimalisation again in Parliament in 1853,[60] resulting in the Chancellor of the Exchequer, William Gladstone, announcing soon afterwards that "the great question of a decimal coinage" was "now under serious consideration".[61] A full proposal for the decimalisation of sterling was then tabled in the House of Commons in June 1855, by William Brown, MP for Lancashire Southern, with the suggestion that the pound sterling be divided into one thousand parts, each called a "mil", or alternatively a farthing, as the pound was then equivalent to 960 farthings which could easily be rounded up to one thousand farthings in the new system.[62] This did not result in the conversion of the pound sterling into a decimal system, but it was agreed to establish a Royal Commission to look into the issue.[63] However, largely due to the hostility to decimalisation of two of the appointed commissioners, Lord Overstone (a banker) and John Hubbard (Governor of the Bank of England), decimalisation in Britain was effectively quashed for over a hundred years.[64]

However, the pound sterling was decimalised in various British colonial territories before the United Kingdom (and in several cases in line with William Brown's proposal that the pound be divided into 1,000 parts, called mils). These included Hong Kong from 1863 to 1866;[65] Cyprus from 1955 until 1960 (and continued on the island as the division of the Cypriot pound until 1983); and the Palestine Mandate from 1926 until 1948.[66]

Towards the end of the Second World War, various attempts to decimalise the pound sterling in the United Kingdom were made.[출처 필요] Later, in 1966, the UK Government decided to include in the Queen's Speech a plan to convert the pound into a decimal currency.[67] As a result of this, on 15 February 1971, the UK decimalised the pound sterling, replacing the shilling and the penny with a single subdivision, the new penny. For example, a price tag of £1 12s 6d became £1.62+1⁄2. The word "new" was omitted from coins minted after 1981.

Free-floating pound[편집]

With the breakdown of the Bretton Woods system, the pound floated from August 1971 onwards. At first, it appreciated a little, rising to almost $2.65 in March 1972 from $2.42, the upper bound of the band in which it had been fixed. The sterling area effectively ended at this time, when the majority of its members also chose to float freely against the pound and the dollar.

1976 sterling crisis[편집]

James Callaghan became Prime Minister in 1976. He was immediately told the economy was facing huge problems, according to documents released in 2006 by the National Archives.[68] The effects of the 1973 oil crisis were still being felt, with inflation rising to nearly 27% in 1975.[69] Financial markets were beginning to believe the pound was overvalued, and in April that year The Wall Street Journal advised the sale of sterling investments in the face of high taxes, in a story that ended with "goodbye, Great Britain. It was nice knowing you".[70] At the time the UK Government was running a budget deficit, and the Labour government at the time's strategy emphasised high public spending.[55] Callaghan was told there were three possible outcomes: a disastrous free fall in sterling, an internationally unacceptable siege economy, or a deal with key allies to prop up the pound while painful economic reforms were put in place. The US Government feared the crisis could endanger NATO and the European Economic Community (EEC), and in light of this the US Treasury set out to force domestic policy changes. In November 1976, the International Monetary Fund (IMF) announced the conditions for a loan, including deep cuts in public expenditure.[71]

1979–1989[편집]

The Conservative Party was elected to office in 1979, on a programme of fiscal austerity. Initially, the pound rocketed, moving above US$2.40, as interest rates rose in response to the monetarist policy of targeting money supply. The high exchange rate was widely blamed for the deep recession of 1981. Sterling fell sharply after 1980; at its lowest, the pound stood at just $1.03 in March 1985, before rising to $1.70 in December 1989.[72]

Following the Deutsche Mark[편집]

In 1988, Margaret Thatcher's Chancellor of the Exchequer, Nigel Lawson, decided that the pound should "shadow" the West German Deutsche Mark (DM), with the unintended result of a rapid rise in inflation as the economy boomed due to low interest rates. (For ideological reasons, the Conservative Government declined to use alternative mechanisms to control the explosion of credit. For this reason, former Prime Minister Edward Heath referred to Lawson as a "one club golfer".)[73]

Following German reunification in 1990, the reverse held true, as high German borrowing costs to fund Eastern reconstruction, exacerbated by the political decision to convert the Ostmark to the DM on a 1:1 basis, meant that interest rates in other countries shadowing the DM, especially the UK, were far too high relative to domestic circumstances, leading to a housing decline and recession.

Following the European Currency Unit[편집]

On 8 October 1990 the Conservative government (Third Thatcher ministry) decided to join the European Exchange Rate Mechanism (ERM), with the pound set at DM2.95. However, the country was forced to withdraw from the system on "Black Wednesday" (16 September 1992) as Britain's economic performance made the exchange rate unsustainable.

"Black Wednesday" saw interest rates jump from 10% to 15% in an unsuccessful attempt to stop the pound from falling below the ERM limits. The exchange rate fell to DM2.20. Those who had argued[74] for a lower GBP/DM exchange rate were vindicated since the cheaper pound encouraged exports and contributed to the economic prosperity of the 1990s.

Following inflation targets[편집]

In 1997, the newly elected Labour government handed over day-to-day control of interest rates to the Bank of England (a policy that had originally been advocated by the Liberal Democrats).[75] The Bank is now responsible for setting its base rate of interest so as to keep inflation (as measured by the Consumer Price Index (CPI)) very close to 2% per annum. Should CPI inflation be more than one percentage point above or below the target, the Governor of the Bank of England is required to write an open letter to the Chancellor of the Exchequer explaining the reasons for this and the measures which will be taken to bring this measure of inflation back in line with the 2% target. On 17 April 2007, annual CPI inflation was reported at 3.1% (inflation of the Retail Prices Index was 4.8%). Accordingly, and for the first time, the Governor had to write publicly to the UK Government explaining why inflation was more than one percentage point higher than its target.[76]

Euro[편집]

In 2007, Gordon Brown, then Chancellor of the Exchequer, ruled out membership in the eurozone for the foreseeable future, saying that the decision not to join had been right for Britain and for Europe.[77]

On 1 January 2008, with the Republic of Cyprus switching its currency from the Cypriot pound to the euro, the British sovereign bases on Cyprus (Akrotiri and Dhekelia) followed suit, making the Sovereign Base Areas the only territory under British sovereignty to officially use the euro.[78]

The government of former Prime Minister Tony Blair had pledged to hold a public referendum to decide on the adoption of the Euro should "five economic tests" be met, to increase the likelihood that any adoption of the euro would be in the national interest. In addition to these internal (national) criteria, the UK would have to meet the European Union's economic convergence criteria (Maastricht criteria) before being allowed to adopt the euro. The Conservative and Liberal Democrat coalition government (2010–2015) ruled out joining the euro for that parliamentary term.

The idea of replacing the pound with the euro was always controversial with the British public, partly because of the pound's identity as a symbol of British sovereignty and because it would, according to some critics, have led to suboptimal interest rates, harming the British economy.[79] In December 2008, the results of a BBC poll of 1000 people suggested that 71% would vote no to the euro, 23% would vote yes, while 6% said they were unsure.[80] The pound did not join the Second European Exchange Rate Mechanism (ERM II) after the euro was created. Denmark and the UK had opt-outs from entry to the euro. Theoretically, every EU nation but Denmark must eventually sign up.

As a member of the European Union, the United Kingdom could have adopted the euro as its currency. However, the subject was always politically controversial, and the UK negotiated an opt-out on this issue. Following the UK's withdrawal from the EU, on 31 January 2020, the Bank of England ended its membership of the European System of Central Banks,[81] and shares in the European Central Bank were reallocated to other EU banks.[82]

Recent exchange rates[편집]

The pound and the euro fluctuate in value against one another, although there may be correlation between movements in their respective exchange rates with other currencies such as the US dollar. Inflation concerns in the UK led the Bank of England to raise interest rates in late 2006 and 2007. This caused the pound to appreciate against other major currencies and, with the US dollar depreciating at the same time, the pound hit a 15-year high against the US dollar on 18 April 2007, reaching US$2 the day before, for the first time since 1992. The pound and many other currencies continued to appreciate against the dollar; sterling hit a 26-year high of US$2.1161 on 7 November 2007 as the dollar fell worldwide.[83] From mid-2003 to mid-2007, the pound/euro rate remained within a narrow range (€1.45 ± 5%).[84]

Following the global financial crisis in late 2008, the pound depreciated sharply, reaching $1.38 (US) on 23 January 2009[85] and falling below €1.25 against the euro in April 2008.[86] There was a further decline during the remainder of 2008, most dramatically on 29 December when its euro rate hit an all-time low at €1.0219, while its US dollar rate depreciated.[87][88] The pound appreciated in early 2009, reaching a peak against the euro of €1.17 in mid-July. In the following months the pound remained broadly steady against the euro, with the pound valued on 27 May 2011 at €1.15 and US$1.65.

On 5 March 2009, the Bank of England announced that it would pump £75 billion of new capital into the British economy, through a process known as quantitative easing (QE). This was the first time in the United Kingdom's history that this measure had been used, although the Bank's Governor Mervyn King suggested it was not an experiment.[89]

The process saw the Bank of England creating new money for itself, which it then used to purchase assets such as government bonds, secured commercial paper, or corporate bonds.[90] The initial amount stated to be created through this method was £75 billion, although Chancellor of the Exchequer Alistair Darling had given permission for up to £150 billion to be created if necessary.[91] It was expected that the process would continue for three months, with results only likely in the long term.[89] By 5 November 2009, some £175 billion had been injected using QE, and the process remained less effective in the long term. In July 2012, the final increase in QE meant it had peaked at £375 billion, then holding solely UK Government bonds, representing one third of the UK national debt.[92]

The result of the 2016 UK referendum on EU membership caused a major decline in the pound against other world currencies as the future of international trade relationships and domestic political leadership became unclear.[93] The referendum result weakened sterling against the euro by 5% overnight. The night before the vote, the pound was trading at €1.30; the next day, this had fallen to €1.23. By October 2016, the exchange rate was €1.12 to the pound, a fall of 14% since the referendum. By the end of August 2017 the pound was even lower, at €1.08.[94] Against the US dollar, meanwhile, the pound fell from $1.466 to $1.3694 when the referendum result was first revealed, and down to $1.2232 by October 2016, a fall of 16%.[95]

Annual inflation rate[편집]

The Bank of England had stated in 2009 that the decision had been taken to prevent the rate of inflation falling below the 2% target rate.[90] Mervyn King, the Governor of the Bank of England, had also suggested there were no other monetary options left, as interest rates had already been cut to their lowest level ever (0.5%) and it was unlikely that they would be cut further.[91]

The inflation rate rose in following years, reaching 5.2% per year (based on the Consumer Price Index) in September 2011, then decreased to around 2.5% the following year.[96]

Coins[편집]

Pre-decimal coins[편집]

The silver penny (plural: pence; abbreviation: d) was the principal and often the only coin in circulation from the 8th century until the 13th century. Although some fractions of the penny were struck (see farthing and halfpenny), it was more common to find pennies cut into halves and quarters to provide smaller change. Very few gold coins were struck, with the gold penny (worth 20 silver pence) a rare example. However, in 1279, the groat, worth 4d, was introduced, with the half groat following in 1344. 1344 also saw the establishment of a gold coinage with the introduction (after the failed gold florin) of the noble worth six shillings and eight pence (6/8) (i.e. 3 nobles to the pound), together with the half and quarter noble. Reforms in 1464 saw a reduction in value of the coinage in both silver and gold, with the noble renamed the ryal and worth 10/– (i.e. 2 to the pound) and the angel introduced at the noble's old value of 6/8.

The reign of Henry VII saw the introduction of two important coins: the shilling (abbr.: s; known as the testoon, equivalent to twelve pence) in 1487 and the pound (known as the sovereign, abbr.: £ or L, equivalent to twenty shillings) in 1489. In 1526, several new denominations of gold coins were added, including the crown and half crown, worth five shillings (5/–) and two shillings and six pence (2/6, two and six) respectively. Henry VIII's reign (1509–1547) saw a high level of debasement which continued into the reign of Edward VI (1547–1553). This debasement was halted in 1552, and new silver coinage was introduced, including coins for 1d, 2d, 3d, 4d and 6d, 1/–, 2/6 and 5/–. In the reign of Elizabeth I (1558–1603), silver 3⁄4d and 1+1⁄2d coins were added, but these denominations did not last. Gold coins included the half-crown, crown, angel, half-sovereign (10/–) and sovereign (£1). Elizabeth's reign also saw the introduction of the horse-drawn screw press to produce the first "milled" coins.

Following the succession of the Scottish King James VI to the English throne, a new gold coinage was introduced, including the spur ryal (15/–), the unite (20/–) and the rose ryal (30/–). The laurel, worth 20/–, followed in 1619. The first base metal coins were also introduced: tin and copper farthings. Copper halfpenny coins followed in the reign of Charles I. During the English Civil War, a number of siege coinages were produced, often in unusual denominations.

Following the restoration of the monarchy in 1660, the coinage was reformed, with the ending of production of hammered coins in 1662. The guinea was introduced in 1663, soon followed by the 1⁄2, 2 and 5 guinea coins. The silver coinage consisted of denominations of 1d, 2d, 3d, 4d and 6d, 1/–, 2/6 and 5/–. Due to the widespread export of silver in the 18th century, the production of silver coins gradually came to a halt, with the half crown and crown not issued after the 1750s, the 6d and 1/– stopping production in the 1780s. In response, copper 1d and 2d coins and a gold 1⁄3 guinea (7/–) were introduced in 1797. The copper penny was the only one of these coins to survive long.

To alleviate the shortage of silver coins, between 1797 and 1804, the Bank of England counterstamped Spanish dollars (8 reales) and other Spanish and Spanish colonial coins for circulation. A small counterstamp of the King's head was used. Until 1800, these circulated at a rate of 4/9 for 8 reales. After 1800, a rate of 5/- for 8 reales was used. The Bank then issued silver tokens for 5/– (struck over Spanish dollars) in 1804, followed by tokens for 1/6 and 3/– between 1811 and 1816.

In 1816, a new silver coinage was introduced in denominations of 6d, 1/–, 2/6 (half-crown) and 5/– (crown). The crown was only issued intermittently until 1900. It was followed by a new gold coinage in 1817 consisting of 10/– and £1 coins, known as the half sovereign and sovereign. The silver 4d coin was reintroduced in 1836, followed by the 3d in 1838, with the 4d coin issued only for colonial use after 1855. In 1848, the 2/– florin was introduced, followed by the short-lived double florin in 1887. In 1860, copper was replaced by bronze in the farthing (quarter penny, 1⁄4d), halfpenny and penny.

During the First World War, production of the sovereign and half-sovereign was suspended, and although the gold standard was later restored, the coins saw little circulation thereafter. In 1920, the silver standard, maintained at .925 since 1552, was reduced to .500. In 1937, a nickel-brass 3d coin was introduced; the last silver 3d coins were issued seven years later. In 1947, the remaining silver coins were replaced with cupro-nickel, with the exception of Maundy coinage which was then restored to .925. Inflation caused the farthing to cease production in 1956 and be demonetised in 1960. In the run-up to decimalisation, the halfpenny and half-crown were demonetised in 1969.

Decimal coins[편집]

틀:Coin image box 2 singles British coinage timeline:

- 1968: The first decimal coins were introduced. These were cupro-nickel 5p and 10p coins which were the same size as, equivalent in value to, and circulated alongside, the one shilling coin and the florin (two shilling coin) respectively.

- 1969: The curved equilateral heptagonal cupro-nickel 50p coin replaced the ten shilling banknote (10/–).

- 1970: The Half crown (2/6, 12.5p) was demonetised.

- 1971: The decimal coinage was completed when decimalisation came into effect in 1971 with the introduction of the bronze half new penny (1⁄2p), new penny (1p), and two new pence (2p) coins and the withdrawal of the (old) penny (1d) and (old) threepence (3d) coins.

- 1980: Withdrawal of the sixpence (6d) coin, which had continued in circulation at a value of 2+1⁄2p.

- 1982: The word "new" was dropped from the coinage and a 20p coin was introduced.

- 1983: A (round, brass) £1 coin was introduced.

- 1983: The 1⁄2p coin was last produced.

- 1984: The 1⁄2p coin was withdrawn from circulation.

- 1990: The crown, historically valued at five shillings (25p), was re-tariffed for future issues as a commemorative coin at £5.

- 1990: A new 5p coin was introduced, replacing the original size that had been the same as the shilling coins of the same value that it had in turn replaced. These first generation 5p coins and any remaining old shilling coins were withdrawn from circulation in 1991.

- 1992: A new 10p coin was introduced, replacing the original size that had been the same as the florin or two shilling coins of the same value that it had in turn replaced. These first generation 10p coins and any remaining old florin coins were withdrawn from circulation over the following two years.

- 1992: 1p and 2p coins began to be minted in copper-plated steel (the original bronze coins continued in circulation).

- 1997: A new 50p coin was introduced, replacing the original size that had been in use since 1969, and the first generation 50p coins were withdrawn from circulation.

- 1998: The bi-metallic £2 coin was introduced.

- 2007: By now the value of copper in the pre-1992 1p and 2p coins (which are 97% copper) exceeded those coins' face value to such an extent that melting down the coins by entrepreneurs was becoming worthwhile (with a premium of up to 11%, with smelting costs reducing this to around 4%)—although this is illegal, and the market value of copper has subsequently fallen dramatically from these earlier peaks.

- In April 2008, an extensive redesign of the coinage was unveiled. The 1p, 2p, 5p, 10p, 20p, and 50p coins feature parts of the Royal Shield on their reverse; and the reverse of the pound coin showed the whole shield. The coins were issued gradually into circulation, starting in mid-2008. They have the same sizes, shapes and weights as those with the old designs which, apart from the round pound coin which was withdrawn in 2017, continue to circulate.

- 2012: The 5p and 10p coins were changed from cupro-nickel to nickel-plated steel.

- 2016: The Royal Mint began minting legal tender decimal sixpence coins in silver,[97] not intended for regular circulation but to be bought as Christmas presents and for the traditional wedding tradition for the bride: "and a silver sixpence in your shoe".[98]

- 2017: A more secure twelve-sided bi-metallic £1 coin was introduced to reduce forgery. The old round £1 coin ceased to be legal tender on 15 October 2017.[99]

2020년 기준[update], the oldest circulating coins in the UK are the 1p and 2p copper coins introduced in 1971. No other coins from before 1982 are in circulation. Prior to the withdrawal from circulation in 1992, the oldest circulating coins had usually dated from 1947: although older coins (shilling; florin, sixpence to 1980) were still legal tender, inflation meant that their silver content was worth more than their face value, which meant that they tended to be removed from circulation. Before decimalisation in 1971, a handful of change might have contained coins 100 or more years old, bearing any of five monarchs' heads, especially in the copper coins.

Banknotes[편집]

The first sterling notes were issued by the Bank of England shortly after its foundation in 1694. Denominations were initially handwritten on the notes at the time of issue. From 1745, the notes were printed in denominations between £20 and £1000, with any odd shillings added by hand. £10 notes were added in 1759, followed by £5 in 1793 and £1 and £2 in 1797. The lowest two denominations were withdrawn after the end of the Napoleonic wars. In 1855, the notes were converted to being entirely printed, with denominations of £5, £10, £20, £50, £100, £200, £300, £500 and £1000 issued.

The Bank of Scotland began issuing notes in 1695. Although the pound Scots was still the currency of Scotland, these notes were denominated in sterling in values up to £100. From 1727, the Royal Bank of Scotland also issued notes. Both banks issued some notes denominated in guineas as well as pounds. In the 19th century, regulations limited the smallest note issued by Scottish banks to be the £1 denomination, a note not permitted in England.

With the extension of sterling to Ireland in 1825, the Bank of Ireland began issuing sterling notes, later followed by other Irish banks. These notes included the unusual denominations of 30/- and £3. The highest denomination issued by the Irish banks was £100.

In 1826, banks at least 65 마일 (105 km) from London were given permission to issue their own paper money. From 1844, new banks were excluded from issuing notes in England and Wales but not in Scotland and Ireland. Consequently, the number of private banknotes dwindled in England and Wales but proliferated in Scotland and Ireland. The last English private banknotes were issued in 1921.

In 1914, the Treasury introduced notes for 10/- and £1 to replace gold coins. These circulated until 1928 when they were replaced by Bank of England notes. Irish independence reduced the number of Irish banks issuing sterling notes to five operating in Northern Ireland. The Second World War had a drastic effect on the note production of the Bank of England. Fearful of mass forgery by the Nazis (see Operation Bernhard), all notes for £10 and above ceased production, leaving the bank to issue only 10/-, £1 and £5 notes. Scottish and Northern Irish issues were unaffected, with issues in denominations of £1, £5, £10, £20, £50 and £100.

The Bank of England reintroduced £10 notes in 1964. In 1969, the 10/- note was replaced by the 50p coin to prepare for decimalisation. £20 Bank of England notes were reintroduced in 1970, followed by £50 in 1981.[100] A £1 coin was introduced in 1983, and Bank of England £1 notes were withdrawn in 1988. Scottish and Northern Irish banks followed, with only the Royal Bank of Scotland continuing to issue this denomination.

UK notes include raised print (e.g. on the words "Bank of England"); watermarks; embedded metallic thread; holograms; and fluorescent ink visible only under UV lamps. Three printing techniques are involved: offset litho, intaglio and letterpress; and the notes incorporate a total of 85 specialized inks.[101]

The Bank of England produces notes named "giant" and "titan". A giant is a one million pound note, and a titan is a one hundred million pound bank note.[102] Giants and titans are used only within the banking system.[103]

Polymer banknotes[편집]

The Northern Bank £5 note, issued by (Northern Ireland's) Northern Bank (now Danske Bank) in 2000, was the only polymer banknote in circulation until 2016. The Bank of England introduced £5 polymer banknotes in September 2016, and the paper £5 notes were withdrawn on 5 May 2017. A polymer £10 banknote was introduced on 14 September 2017, and the paper note was withdrawn on 1 March 2018. A polymer £20 banknote was introduced on 20 February 2020, to be followed by a polymer £50 in 2021.[104]

Monetary policy[편집]

As the central bank of the United Kingdom which has been delegated authority by the government, the Bank of England sets the monetary policy for the British pound by controlling the amount of money in circulation. It has a monopoly on the issuance of banknotes in England and Wales and regulates the amount of banknotes issued by seven authorized banks in Scotland and Northern Ireland.[105] HM Treasury has reserve powers to give orders to the committee "if they are required in the public interest and by extreme economic circumstances" but such orders must be endorsed by Parliament within 28 days.[106]

Unlike banknotes which have separate issuers in Scotland and Northern Ireland, all UK coins are issued by the Royal Mint, which is an independent enterprise (wholly owned by the Treasury) which also mints coins for other countries.

In Britain's Crown Dependencies, the Manx pound, Jersey pound, and Guernsey pound are unregulated by the Bank of England and are issued independently.[107] However, they are maintained at a fixed exchange rate by their respective governments, and Bank of England notes have been made legal tender on the islands, forming a sort of one-way de facto currency union. These currencies do not have ISO 4217 codes, so "GBP" is usually used to represent all of them; informal codes are used where the difference is important.

British Overseas Territories are responsible for the monetary policy of their own currencies (where they exist),[108] and have their own ISO 4217 codes. The Falkland Islands pound, Gibraltar pound, and Saint Helena pound are set at a fixed 1:1 exchange rate with the British pound by local governments.

Legal tender and national issues[편집]

Legal tender in the United Kingdom is defined such that "a debtor cannot successfully be sued for non-payment if he pays into court in legal tender." Parties can alternatively settle a debt by other means with mutual consent. Strictly speaking, it is necessary for the debtor to offer the exact amount due as there is no obligation for the other party to provide change.[109]

Throughout the UK, £1 and £2 coins are legal tender for any amount, with the other coins being legal tender only for limited amounts. Bank of England notes are legal tender for any amount in England and Wales, but not in Scotland or Northern Ireland.[109] (Bank of England 10/- and £1 notes were legal tender, as were Scottish banknotes, during World War II under the Currency (Defence) Act 1939, which was repealed on 1 January 1946.) Channel Islands and Isle of Man banknotes are legal tender only in their respective jurisdictions.[110]

Bank of England, Scottish, Northern Irish, Channel Islands, Isle of Man, Gibraltar, and Falkland banknotes may be offered anywhere in the UK, although there is no obligation to accept them as a means of payment, and acceptance varies. For example, merchants in England generally accept Scottish and Northern Irish bills, but some unfamiliar with them may reject them.[111] However, Scottish and Northern Irish bills both tend to be accepted in Scotland and Northern Ireland, respectively. Merchants in England generally do not accept Jersey, Guernsey, Isle of Man, Gibraltar, and Falkland notes but Isle of Man notes are generally accepted in Northern Ireland.[112] Bank of England notes are generally accepted in the Falklands and Gibraltar, but for example, Scottish and Northern Irish notes are not.[113] Since all of the bills are denominated in pounds sterling, banks will exchange them for locally issued bills at face value,[114]틀:Failed verification though some in the UK have had trouble exchanging Falkland Islands pounds.[115]

Commemorative £5 and 25p (crown) coins, and 6p coins made for traditional wedding ceremonies and Christmas gifts, rarely seen in circulation, are legal tender, as are the bullion coins issued by the Mint.

| Coin | Maximum usable as legal tender[116] |

|---|---|

| £100 (produced from 2015)[109] | unlimited |

| £20 (produced from 2013) | unlimited |

| £5 (post-1990 crown) | unlimited |

| £2 | unlimited |

| £1 | unlimited |

| 50p | £10 |

| 25p (pre-1990 crown) | £10 |

| 20p | £10 |

| 10p | £5 |

| 5p | £5 |

| 2p | 20p |

| 1p | 20p |

Value[편집]

In 2006, the House of Commons Library published a research paper which included an index of prices in pounds for each year between 1750 and 2005, where 1974 was indexed at 100.[117]

Regarding the period 1750–1914 the document states: "Although there was considerable year on year fluctuation in price levels prior to 1914 (reflecting the quality of the harvest, wars, etc.) there was not the long-term steady increase in prices associated with the period since 1945". It goes on to say that "Since 1945 prices have risen in every year with an aggregate rise of over 27 times".

The value of the index in 1751 was 5.1, increasing to a peak of 16.3 in 1813 before declining very soon after the end of the Napoleonic Wars to around 10.0 and remaining in the range 8.5–10.0 at the end of the 19th century. The index was 9.8 in 1914 and peaked at 25.3 in 1920, before declining to 15.8 in 1933 and 1934—prices were only about three times as high as they had been 180 years earlier.[118]

Inflation has had a dramatic effect during and after World War II: the index was 20.2 in 1940, 33.0 in 1950, 49.1 in 1960, 73.1 in 1970, 263.7 in 1980, 497.5 in 1990, 671.8 in 2000 and 757.3 in 2005.

The following table shows the equivalent amount of goods and services that, in a particular year, could be purchased with £1.[119]

The table shows that from 1971 to 2015 the British pound lost about 92 per cent of its buying power.

| Year | Equivalent buying power | Year | Equivalent buying power | Year | Equivalent buying power | Year | Equivalent buying power | Year | Equivalent buying power |

|---|---|---|---|---|---|---|---|---|---|

| 1971 | £1.00 | 1981 | £0.271 | 1991 | £0.152 | 2001 | £0.117 | 2011 | £0.0900 |

| 1972 | £0.935 | 1982 | £0.250 | 1992 | £0.146 | 2002 | £0.115 | 2012 | £0.0850 |

| 1973 | £0.855 | 1983 | £0.239 | 1993 | £0.144 | 2003 | £0.112 | 2013 | £0.0826 |

| 1974 | £0.735 | 1984 | £0.227 | 1994 | £0.141 | 2004 | £0.109 | 2014 | £0.0800 |

| 1975 | £0.592 | 1985 | £0.214 | 1995 | £0.136 | 2005 | £0.106 | 2015 | £0.0780 |

| 1976 | £0.510 | 1986 | £0.207 | 1996 | £0.133 | 2006 | £0.102 | 2016 | £0.0777 |

| 1977 | £0.439 | 1987 | £0.199 | 1997 | £0.123 | 2007 | £0.0980 | 2017 | £0.0744 |

| 1978 | £0.407 | 1988 | £0.190 | 1998 | £0.125 | 2008 | £0.0943 | 2018 | £0.0726 |

| 1979 | £0.358 | 1989 | £0.176 | 1999 | £0.123 | 2009 | £0.0952 | ||

| 1980 | £0.303 | 1990 | £0.161 | 2000 | £0.119 | 2010 | £0.0910 |

The smallest coin in 1971 was the 1⁄2p, worth about 6.4p in 2015 prices.

Exchange rate[편집]

The pound is freely bought and sold on the foreign exchange markets around the world, and its value relative to other currencies therefore fluctuates.[b]

| 현재 GBP 환율 | |

|---|---|

| 구글 파이낸스: | AUD CAD CHF CNY EUR HKD JPY KRW USD INR |

| 야후! 파이낸스: | AUD CAD CHF CNY EUR HKD JPY KRW USD INR |

| XE.com: | AUD CAD CHF CNY EUR HKD JPY KRW USD INR |

| OANDA: | AUD CAD CHF CNY EUR HKD JPY KRW USD INR |

Reserve[편집]

Sterling is used as a reserve currency around the world. 2019년 기준[update], it is ranked fourth in value held as reserves.

| 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 미국 달러 | 61.69% | 62.72% | 65.36% | 65.74% | 65.17% | 61.27% | 61.50% | 62.69% | 62.24% | 62.15% | 63.77% | 63.87% | 65.04% | 66.51% | 65.51% | 65.45% | 66.50% | 71.51% | 71.13% | 71.01% | 69.28% | 65.10% | 61.98% | 58.96% |

| 유로(1998년까지는 ECU) | 20.69% | 20.16% | 19.14% | 19.15% | 21.21% | 24.21% | 24.06% | 24.44% | 25.76% | 27.70% | 26.21% | 26.14% | 24.99% | 23.89% | 24.68% | 25.03% | 23.65% | 19.18% | 18.29% | 17.90% | 1.30% | 6.07% | 7.08% | 8.53% |

| 독일 마르크 | 13.79% | 14.48% | 14.67% | 15.75% | ||||||||||||||||||||

| 프랑스 프랑 | 1.62% | 1.44% | 1.85% | 2.35% | ||||||||||||||||||||

| 네덜란드 휠던 | 0.27% | 0.35% | 0.24% | 0.32% | ||||||||||||||||||||

| 일본 엔 | 5.20% | 4.90% | 3.96% | 3.75% | 3.55% | 3.82% | 4.09% | 3.61% | 3.66% | 2.90% | 3.47% | 3.18% | 3.46% | 3.96% | 4.28% | 4.42% | 4.94% | 5.04% | 6.06% | 6.37% | 6.24% | 5.77% | 6.71% | 6.77% |

| 영국 파운드 스털링 | 4.43% | 4.53% | 4.34% | 4.72% | 3.70% | 3.99% | 4.04% | 3.84% | 3.94% | 4.25% | 4.22% | 4.82% | 4.52% | 3.75% | 3.49% | 2.86% | 2.92% | 2.70% | 2.75% | 2.89% | 2.66% | 2.58% | 2.68% | 2.11% |

| 중국 런민비 | 1.89% | 1.23% | 1.07% | |||||||||||||||||||||

| 캐나다 달러 | 1.84% | 2.03% | 1.94% | 1.78% | 1.75% | 1.83% | 1.43% | |||||||||||||||||

| 오스트레일리아 달러 | 1.62% | 1.80% | 1.69% | 1.77% | 1.60% | 1.82% | 1.46% | |||||||||||||||||

| 스위스 프랑 | 0.15% | 0.18% | 0.17% | 0.27% | 0.24% | 0.27% | 0.21% | 0.08% | 0.13% | 0.12% | 0.14% | 0.16% | 0.17% | 0.15% | 0.17% | 0.23% | 0.41% | 0.25% | 0.27% | 0.23% | 0.33% | 0.35% | 0.24% | 0.32% |

| 기타 | 2.48% | 2.44% | 2.34% | 2.83% | 2.79% | 2.80% | 3.21% | 5.33% | 4.27% | 2.88% | 2.20% | 1.83% | 1.81% | 1.74% | 1.87% | 2.01% | 1.58% | 1.31% | 1.49% | 1.60% | 4.50% | 3.86% | 4.48% | 4.87% |

| 출처: 국제 통화 기금: [1] | ||||||||||||||||||||||||

See also[편집]

- Commonwealth banknote-issuing institutions

- List of British currencies

- List of currencies in Europe

- List of the largest trading partners of United Kingdom

- Pound (currency) – other currencies called "pound"

Footnotes[편집]

- ↑ £50 in 1966 is about £952 today.

- ↑ For historic exchange rates with the pound, see OandA.com Currency Converter

References[편집]

- ↑ “sterling | Definition of sterling in English by Oxford Dictionaries”. 《Oxford Dictionaries | English》. 2019년 1월 22일에 확인함.

- ↑ “British Antarctic Territory Currency Ordinance 1990”.

- ↑ “Foreign and Commonwealth Office country profiles: British Antarctic Territory”. British Foreign & Commonwealth Office. 2010년 3월 25일. 2009년 4월 20일에 원본 문서에서 보존된 문서. 2010년 4월 17일에 확인함.

- ↑ “Foreign and Commonwealth Office country profiles: Tristan da Cunha”. British Foreign & Commonwealth Office. 2010년 2월 12일. 2010년 6월 30일에 원본 문서에서 보존된 문서. 2010년 4월 17일에 확인함.

- ↑ Jeff Desjardins (2016년 12월 29일). “Here are the most traded currencies in 2016”. Business Insider. 2017년 6월 30일에 확인함.

- ↑ “Currency Composition of Official Foreign Exchange Reserves”. International Monetary Fund. 2021년 6월 28일. 2021년 6월 28일에 확인함.

- ↑ Currency Act 1992 (an Act of Tynwald) section 1)틀:Better source needed

- ↑ 〈Entry 189985〉. 《OED Online》. Oxford University Press. December 2011. 2012년 2월 28일에 확인함.

sterling, n.1 and adj.

- ↑ 〈Sterling〉. 《Online Etymology Dictionary》. 2014년 2월 19일에 확인함.

- ↑ “Easterling theory”. Sterling Judaica. 2013년 12월 30일에 원본 문서에서 보존된 문서. 2014년 2월 19일에 확인함.

- ↑ 〈Entry: "sterling"〉. 《dict.org》.

- ↑ Huffman, Joseph P. (2003년 11월 13일). 《Family, Commerce, and Religion in London and Cologne》. ISBN 9780521521932. 2016년 9월 16일에 확인함.

- ↑ 《The Journal of the Manchester Geographical Society, Volumes 19–20》. 1903. 129쪽. 2016년 9월 16일에 확인함.

- ↑ pound sterling, Britannica

- ↑ 〈troy, n.2〉. 《Oxford English Dictionary》. Oxford, England: Oxford University Press. June 2012.

The received opinion is that it took its name from a weight used at the fair of Troyes in France

- ↑ Partridge, Eric (1958). 〈Trojan〉. 《Origins: A Short Etymological Dictionary of Modern English》. London: Routledge and Kegan Paul. 3566쪽. OCLC 250202885.

…the great fairs established for all Europe the weight-standard Troyes, whence…Troy…

- ↑ 가 나 “Withdrawn banknotes”. Bank of England. 2019년 9월 13일에 확인함. ("£1 1st Series Treasury Issue" to "£5 Series B")

- ↑ “Current banknotes”. Bank of England. 2019년 11월 8일에 확인함.

- ↑ For example,Samuel Pepys (1660년 1월 2일). “Diary of Samuel Pepys/1660/January”. 2019년 9월 23일에 확인함. Then I went to Mr. Crew's and borrowed L10 of Mr. Andrewes for my own use, and so went to my office, where there was nothing to do.

- ↑ Thomas Snelling (1762). 《A View of the Silver Coin and Coinage of England from the Norman Conquest to the Present Time》. T. Snelling. ii쪽. 2016년 9월 19일에 확인함.

- ↑ “A brief history of the pound”. The Dozenal Society of Great Britain. 2011년 1월 14일에 확인함.

- ↑ 인용 오류:

<ref>태그가 잘못되었습니다;britannica1라는 이름을 가진 주석에 텍스트가 없습니다 - ↑ Pound, Britannica

- ↑ “Shilling”. 《The Royal Mint Museum》. 2014년 11월 29일에 원본 문서에서 보존된 문서. 2019년 9월 11일에 확인함.

- ↑ “Florin”. 《The Royal Mint Museum》. 2015년 2월 27일에 원본 문서에서 보존된 문서. 2019년 9월 11일에 확인함.

- ↑ “1984: Halfpenny coin to meet its maker”. 《BBC News》. 2008. 2014년 2월 14일에 확인함.

- ↑ 가 나 다 라 마 바 사 Shaw, William Arthur (1896년 5월 13일). “The History of Currency, 1252-1894: Being an Account of the Gold and Silver Moneys and Monetary Standards of Europe and America, Together with an Examination of the Effects of Currency and Exchange Phenomena on Commercial and National Progress and Well-being”. Putnam – Google Books 경유.

- ↑ 가 나 Shaw, William Arthur (1896년 5월 13일). “The History of Currency, 1252-1894: Being an Account of the Gold and Silver Moneys and Monetary Standards of Europe and America, Together with an Examination of the Effects of Currency and Exchange Phenomena on Commercial and National Progress and Well-being”. Putnam – Google Books 경유.

- ↑ Rendall, Alasdair (2007년 11월 12일). “Economic terms explained”. 《BBC News》. 2014년 2월 14일에 확인함.

- ↑ “Coin”. British Museum.

- ↑ 〈Pound sterling〉. 《Britannica》.

Silver coins known as "sterlings" were issued in the Saxon kingdoms, 240 of them being minted from a pound of silver... Hence, large payments came to be reckoned in "pounds of sterlings," a phrase later shortened...

- ↑ Lowther, Ed (2014년 2월 14일). “A short history of the pound”. 《BBC News》. BBC.

Anglo-Saxon Offa of Mercia

다음 글자 무시됨: ‘King Offa is credited with introducing the system of money to central and southern England in the latter half of the 8th Century, overseeing the minting of the earliest English silver pennies – emblazoned with his name. In practice they varied considerably in weight and 240 of them seldom added up to a pound. There were at that time no larger denomination coins – pounds and shillings were merely useful units of account.’ (도움말) - ↑ “Halfpenny and Farthing”. 《www.royalmintmuseum.org.uk》.

- ↑ “Coins of the Kings and Queens of England and Great Britain”. Treasure Realm. 2021년 5월 13일에 확인함.

2d, 4d issued since 1347

- ↑ Snelling, Thomas (1763). 《A View Of The Gold Coin And Coinage Of England: From Henry The Third To the Present Time. Consider'd with Regard to Type, Legend, Sorts, Rarity, Weight, Fineness, Value and Proportion》.

The manuscript chronicle of the city of London says this king Henry III in 1258 coined a penny of fine gold of the weight of two sterlings and commanded it should go for 20 shillings if this be true these were the first pieces of gold coined in England NB The date should be 1257 and the value pence

- ↑ Munro, John. “MONEY AND COINAGE IN LATE MEDIEVAL AND EARLY MODERN EUROPE” (PDF). Department of Economics, University of Toronto: 10.

240-243 pennies minted from a Tower Pound.

- ↑ 가 나 “Content and Fineness of the Gold Coins of England and Great Britain: Henry III - Richard III (1257-1485)”. 《treasurerealm.com》.

Fineness 23.875 karats = 191/192, coins in Nobles, Halves, Quarters

- ↑ “Noble (1361-1369) ENGLAND, KINGDOM - EDWARD III, 1327-1377 - n.d., Calais Wonderful coin with fine details. Very impressive.”. 《MA-Shops》.

- ↑ Shaw, William Arthur (1896). 《The History of Currency, 1252-1894: Being an Account of the Gold and Silver Moneys and Monetary Standards of Europe and America, Together with an Examination of the Effects of Currency and Exchange Phenomena on Commercial and National Progress and Well-being》. 33쪽.

In 1427 a Mark (244.752 g) of silver was worth 8 livre tournois or 6.4 livre parisis

Hence one livre weighed 38.24g and one sol at 1.912g. Compare with 40d sterling at 36g, 2d at 1.8g. - ↑ “The Vierlander, a precursor of the Euro. A first step towards monetary unification”. Museum of the National Bank of Belgium.

Stuiver weighs 3,4 g and has a fineness of 479/1000 silver...

which gives the fine silver content of a Stuiver as 3.4 x 0.479 or almost 1.63 g - ↑ Quinn, Stephen (2005). “The big problem of large bills: The Bank of Amsterdam and the origins of central banking (Working Paper, No. 2005-16, Federal Reserve Bank of Atlanta, Atlanta, GA)” (PDF). Leibniz Information Centre for Economics: 8.

- ↑ Stride, H. G. (1955). “The Gold Coinage of Charles II” (PDF). 《British Numismatic Journal》 (British Numismatic Society): 393.

- ↑ MAYS, JAMES O'DONALD (1978). “SILVER TOKENS AND BRISTOL” (PDF). 《British Numismatic Journal》 (British Numismatic Society): 98.

- ↑ Layton, Thomas N. (1997). 《The Voyage of the 'Frolic': New England Merchants and the Opium Trade》. Stanford University Press. 28쪽. ISBN 9780804729093.

- ↑ Bly, Nellie (1890). 〈1〉. 《Around the World in Seventy-Two Days》. The Pictorial Weeklies Company.

- ↑ “Investment > World Gold Council”. Gold.org. 2011년 7월 26일. 2011년 12월 22일에 확인함.

- ↑ “House of Commons Debate 29th October 1945, Second Reading of the Bank of England Bill”. Hansard.millbanksystems.com. 2012년 10월 12일에 확인함.

- ↑ “Bank of England Act 1946” (PDF). 2012년 10월 12일에 확인함.

- ↑ “BBC: Empire of the Seas programme”. webcache.googleusercontent.com. 2010년 5월 10일에 확인함.[깨진 링크(과거 내용 찾기)]

- ↑ UK Retail Price Index inflation figures are based on data from Clark, Gregory (2020). “The Annual RPI and Average Earnings for Britain, 1209 to Present (New Series)”. 《MeasuringWorth》. 2021년 8월 8일에 확인함.

- ↑ “The Interest Burden of Inter-Government Debts”. 《The Economic World》 110: 342. 1922년 9월 2일.

- ↑ Feavearyear, Albert Edgar (1963). 《The pound sterling : A history of English money.》.

- ↑ The Board of Trade Journal, 7 January 1932

- ↑ A History of the Canadian Dollar, p. 51.

- ↑ 가 나 다 Nevin, Louis (1976년 10월 3일). “How the British pound plummeted”. 《Spokesman-Review》 ((Spokane, Washington)). Associated Press. E2면.

- ↑ “British devalue pound, ask $1 million loan”. 《Spokesman-Review》 ((Spokane, Washington)). Associated Press. 1967년 11월 19일. 1, sec. 1면.

- ↑ Hansard Parliamentary Papers, HC Deb, 25 February 1824, vol 10, cc445–49

- ↑ Hansard Parliamentary Papers, HC Deb, 10 August 1833, vol 20, cc482–502

- ↑ Hansard Parliamentary Papers, HC Deb, 27 April 1847, vol 92, cc13–23

- ↑ Hansard Parliamentary Papers, HC Deb, 5 April 1853, vol 125, cc595–96

- ↑ Hansard Parliamentary Papers, HC Deb, 9 June 1853, vol 127, cc1352–59

- ↑ Hansard Parliamentary Papers, HC Deb, 12 June 1855, vol 138, cc1867–909

- ↑ Hansard Parliamentary Papers, HC Deb, 23 July 1857, vol 147, cc304–29

- ↑ Luca Einaudi, European Monetary Unification and the International Gold Standard (1865–1873) (Oxford: Oxford University Press, 2001) p. 144

- ↑ Ma Tak Wo 2004, Illustrated Catalogue of Hong Kong Currency, Ma Tak Wo Numismatic Co., Ltd. Kowloon, Hong Kong.ISBN 962-85939-3-5

- ↑ Howard M. Berlin, The Coins and Banknotes of Palestine Under the British Mandate, 1927–1947 (Jefferson: McFarland, 2001) p. 26f

- ↑ Hansard Parliamentary Papers, HL, Deb 10 March 1966, vol 273, cc1211–16

- ↑ Casciani, Dominic (2006년 12월 29일). “Crisis threatened nuclear weapons”. 《BBC News》. 2010년 4월 17일에 확인함.

- ↑ “The Cabinet Papers – Global oil shortage”. The National Archives. 2010년 12월 22일에 확인함.

- ↑ Martin, Iain (2009년 12월 2일). “Brutal Realism and the Promise of Better Times”. 《The Wall Street Journal》 (New York). 2014년 2월 14일에 확인함.

- ↑ Burk, Kathleen; Cairncross, Alec (1992년 2월 19일). 《Goodbye, Great Britain: The 1976 IMF Crisis》. Yale University Press. ISBN 0-300-05728-8.

- ↑ Samson, Rob (2015년 1월 5일). “GBP Forecast to See Support at 1.40 v US Dollar, But 1983 Lows a Step Too Far”. Pound Sterling Live. 2015년 1월 30일에 확인함.

- ↑ Keegan, William (2003년 10월 26일). “Sometimes it can pay to break the rules”. 《The Observer》 (London). 2014년 2월 14일에 확인함.

- ↑ Wren-Lewis, Simon, et al. (June 1991). "Evaluating the U.K.'s Choice of Entry Rate into the ERM", The Manchester School of Economic & Social Studies Vol. LIV Supplement, University of Manchester, pp. 1–22.

- ↑ 〈Budget Statement〉. 《의회의사록 (핸사드)》. House of Commons. 1997년 7월 2일. col. 303–303.

- ↑ “Rate hike fear as inflation jumps”. 《BBC News》. 2007년 4월 17일. 2010년 4월 17일에 확인함.

- ↑ Treneman, Ann (2007년 7월 24일). “Puritanism comes too naturally for 'Huck' Brown”. 《The Times》 (London). 2014년 2월 14일에 확인함.

- ↑ Theodoulou, Michael (2007년 12월 27일). “Euro reaches field that is for ever England”. 《The Times》 (London). 2014년 2월 14일에 확인함.

- ↑ “Should Britain join the euro?”. 《The Daily Telegraph》 (London). 2003년 5월 12일. 2014년 2월 14일에 확인함.

- ↑ “Most Britons 'still oppose euro'”. 《BBC News》. 2009년 1월 1일. 2010년 4월 17일에 확인함.

- ↑ “ECB welcomes ratification of agreement on orderly UK withdrawal from European Union” (보도 자료). European Central Bank. 2020년 1월 30일. 2020년 6월 29일에 확인함.

- ↑ “ECB's subscribed capital to remain steady after Bank of England leaves the European System of Central Banks” (보도 자료). European Central Bank. 2020년 1월 30일. 2020년 6월 29일에 확인함.

- ↑ “Pound reaches 26-year dollar high”. 《BBC News》. 2007년 4월 18일. 2010년 4월 17일에 확인함.

- ↑ FXGraph: Graphical Display of Currency Rates OANDA.COM

- ↑ “GBPUSD=X: Basic Chart for GBP/USD – Yahoo! Finance”. Finance.yahoo.com. 2010년 4월 17일에 확인함.

- ↑ “ECB ratings: Pound sterling in Euros”. European Central Bank. 2010년 4월 17일에 확인함.

- ↑ “Pound hits new low against euro”. 《BBC News》. 2008년 12월 29일. 2010년 4월 17일에 확인함.

- ↑ “Historical rates”. Oanda Corporation. 2011년 4월 16일. 2011년 11월 6일에 확인함.

- ↑ 가 나 “Bank to pump £75bn into economy”. 《BBC News》. 2009년 3월 5일. 2009년 3월 5일에 확인함.

- ↑ 가 나 “ECB, Bank of England cut rates to record lows”. CNN. 2009년 3월 6일. 2009년 3월 6일에 확인함.

- ↑ 가 나 Duncan, Gary (2009년 3월 6일). “Bank 'prints' £75bn and cuts interest rates in half”. 《The Times》 (London). 2009년 3월 5일에 확인함.

- ↑ Meaden, Sam (2013년 4월 6일). “Bank of England, Asset Purchase Facility – Results”. Bank of England. 2013년 4월 6일에 확인함.

- ↑ Lawrence, Colin. “Exchange Rates Today: British Pound Slumps Vs Euro, Dollar As UK Services Hits Record Low”. 《Exchange Rates UK – Live Coverage of the British Pound & Other G10 Currencies》.

- ↑ “British Pound (GBP) to Euro (EUR) exchange rate history”. 《www.exchangerates.org.uk》.

- ↑ “British Pound (GBP) to US Dollar (USD) exchange rate history”. 《www.exchangerates.org.uk》.

- ↑ Rogers, Simon; Sedghi, Ami (2013년 11월 12일). “UK inflation since 1948”. 《The Guardian》 (London). 2014년 2월 14일에 확인함.

- ↑ “By the Queen a Proclamation Determining the Specification and Design for a New Sixpence Coin in Silver. Elizabeth R.”. 《Thegazette.co.uk》. 2018년 5월 19일에 확인함.

- ↑ “Sixpence & Tradition”. The Royal Mint. 2020년 8월 18일에 확인함.

- ↑ “The new 12-sided £1 coin”. 《The New Pound Coin》. The Royal Mint. 2017년 7월 8일에 원본 문서에서 보존된 문서. 2017년 7월 8일에 확인함.

- ↑ “Notes recently withdrawn from circulation”. Bank of England.

- ↑ Higginbotham, Adam. “The inkjet counterfeiter (Wired UK)”. 《Wired UK》 (Wired.co.uk). 2014년 7월 28일에 확인함.

- ↑ Bowlby, Chris (2013년 1월 26일). “Britain's £1m and £100m banknotes”. 《BBC News》. 2014년 2월 14일에 확인함.

- ↑ “Security by Design – A closer look at Bank of England notes” (PDF). Bank of England. 2016년 5월 7일에 원본 문서 (PDF)에서 보존된 문서. 2011년 11월 6일에 확인함.

- ↑ “Polymer banknotes”. 《www.bankofengland.co.uk》. 2019년 8월 14일에 확인함.

- ↑ “The Bank of England's Role in Regulating the Issuance of Scottish and Northern Ireland Banknotes”. Bank of England. 2014년 7월 28일에 확인함.

- ↑ “Act of Parliament gives devolved responsibility to the MPC with reserve powers for the Treasury”. Opsi.gov.uk. 2010년 5월 10일에 확인함.

- ↑ “Other British Islands' Notes”. Bank of England. 2014년 7월 28일에 확인함.

- ↑ “Can I use coinage from United Kingdom Overseas Territories?”. royalmint.com. 2014년 7월 11일. 2017년 6월 14일에 원본 문서에서 보존된 문서. 2014년 7월 28일에 확인함.

- ↑ 가 나 다 “Legal Tender Guidelines”. 《Royal Mint》. 2014년 5월 13일에 확인함.

- ↑ “Can I use coins from Guernsey, Jersey, Gibraltar and the Isle of Man in the United Kingdom? Why are they made to the same specifications as British coins?”. 《www.royalmintmuseum.org.uk》. 2018년 7월 5일에 확인함.

- ↑ King, Mark (2012년 9월 12일). “Can I spend Scottish money in England?”. 《The Guardian》 (London). 2014년 7월 28일에 확인함.

- ↑ “Currency used in Northern Ireland”. 《www.discoveringireland.com》. 2018년 7월 5일에 확인함.

- ↑ “Foreign travel advice: Gibraltar”. 2014년 3월 23일에 확인함.

- ↑ “100 Falkland Island Pounds to GBP”. 2018년 8월 10일에 확인함.

- ↑ “Foreign travel advice: Falkland Islands”. 2014년 3월 24일에 확인함.

- ↑ “British Royal Mint – What are the legal tender amounts acceptable for the United Kingdom coins?”. 2014년 3월 10일에 원본 문서에서 보존된 문서. 2014년 3월 10일에 확인함.

- ↑ Webb, Dominic (2006년 2월 13일). Inflation: the value of the pound 1750–2005 (PDF) (보고서). House of Commons Library. 2010년 4월 17일에 확인함.

- ↑ O'Donoghue, Jim; Goulding, Louise; Allen, Grahame (March 2004). “Consumer Price Inflation since 1750” (PDF). 《Economic Trends》 (Office for National Statistics) (604): 38–46. ISBN 0-11-621671-9. ISSN 0013-0400. 2014년 2월 14일에 확인함.

- ↑ “Measuring Worth – Purchasing Power of Money in the United Kingdom from 1971 to 2009”. 2010년 4월 3일에 원본 문서에서 보존된 문서. 2010년 4월 22일에 확인함.

Further reading[편집]

- “Bank of England Banknotes FAQ”. 2006년 5월 7일에 확인함.

- The Perspective of the World, Vol III of Civilisation and Capitalism, Fernand Braudel, 1984 ISBN 1-84212-289-4 (in French 1979).

- A Retrospective on the Bretton Woods System : Lessons for International Monetary Reform (National Bureau of Economic Research Project Report) By Barry Eichengreen (Editor), Michael D. Bordo (Editor) Published by University of Chicago Press (1993) ISBN 0-226-06587-1

- The political pound: British investment overseas and exchange controls past—and future? By John Brennan Published By Henderson Administration (1983) ISBN 0-9508735-0-0

- Monetary History of the United States, 1867–1960 by Milton Friedman, Anna Jacobson Schwartz Published by Princeton University Press (1971) ISBN 0-691-00354-8

- The international role of the pound sterling: Its benefits and costs to the United Kingdom By John Kevin Green

- The Financial System in Nineteenth-Century Britain (The Victorian Archives Series), By Mary Poovey Published by Oxford University Press (2002) ISBN 0-19-515057-0

- Rethinking our Centralised Monetary System: The Case for a System of Local Currencies By Lewis D. Solomon Published by Praeger Publishers (1996) ISBN 0-275-95376-9

- Politics and the Pound: The Conservatives' Struggle With Sterling by Philip Stephens Trans-Atlantic Publications (1995) ISBN 0-333-63296-6

- The European Monetary System: Developments and Perspectives (Occasional Paper, No. 73) by Horst Ungerer, Jouko J. Hauvonen Published by International Monetary Fund (1990) ISBN 1-55775-172-2

- The floating pound sterling of the nineteen-thirties: An exploratory study By J. K Whitaker Dept. of the Treasury (1986)

- World Currency Monitor Annual, 1976–1989: Pound Sterling : The Value of the British Pound Sterling in Foreign Terms Published by Mecklermedia (1990) ISBN 0-88736-543-4

- Krause, Chester L., and Clifford Mishler (1991). 《Standard Catalog of World Coins: 1801–1991》 18판. Krause Publications. ISBN 0873411501.

- Pick, Albert (1994). 《Standard Catalog of World Paper Money: General Issues》. Colin R. Bruce II and Neil Shafer (editors) 7판. Krause Publications. ISBN 0-87341-207-9.

- Pick, Albert (1990). 《Standard Catalog of World Paper Money: Specialized Issues》. Colin R. Bruce II and Neil Shafer (editors) 6판. Krause Publications. ISBN 0-87341-149-8.

External links[편집]

- Royal Mint

- Coin Types from Great Britain Lists, pictures, and values of Great Britain coin types

- British Coins – information about British coins (from 1656 to 1952)

- A history of sterling Daily Telegraph

- Purchasing Power of British Pounds from 1264 to 2007

- Five Ways to Compute the Relative Value of a UK Pound Amount, 1830–present

- Images of historic and modern British bank notes

- Pound Sterling – BBC News

- Historical Currency Converter Historical value of the pound in other currencies

- The banknotes of the United Kingdom (영어/독일어)

- Pound Sterling Information about the coins of the modern British pound